If you’re a foreign national living in the UK and planning to buy your first home, one of the most important parts of the mortgage process is getting your documents in order. Lenders won’t just take your word for it, they’ll want to see official paperwork that proves your income, employment, visa status, and deposit.

In this guide, we’ll walk you through the key documents most lenders require, based on what we ask for from our clients every day at First Time Finance.

Why Accurate Documents Matter

Let’s be clear: every document you submit must be original, unaltered, and issued by your employer, bank, or the UK government. We check every detail before submitting anything to a lender, and so will the bank. Mortgage lenders carry out their own verification checks and won’t tolerate anything incorrect or inconsistent.

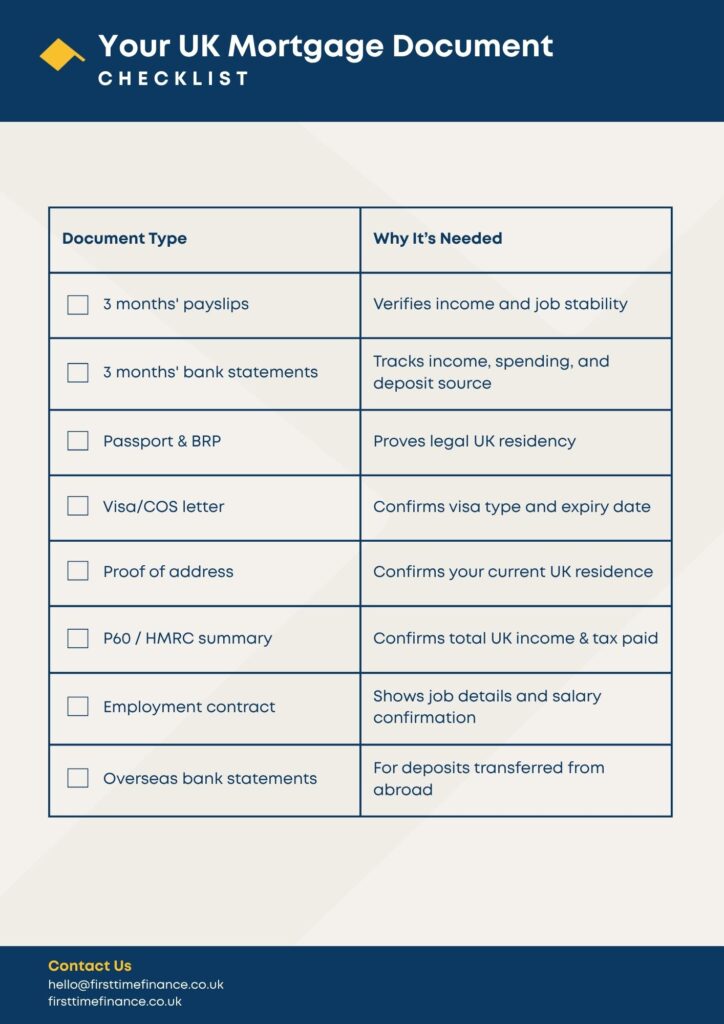

What Documents You’ll Typically Need

1. Payslips (Income Proof)

Lenders usually ask for your last 3 months of payslips.

- If you have two jobs, we’ll need payslips from both.

- If your income varies (e.g. shift work, overtime), you may be asked for more than 3 months.

- Payslips help prove not just your salary, but the stability of your earnings.

2. Bank Statements

Expect to submit 3 months of UK bank statements, showing:

- Where your salary is paid into

- Your day-to-day spending (if separate accounts are used)

- Savings or deposit build-up

If your deposit has come from overseas, lenders will also want to see those bank statements, proof of currency conversion, and the funds arriving in your UK account.

Note: Large unexplained transactions or gifts from friends can raise red flags.

3. Proof of ID & Visa

You’ll need:

- A valid passport

- Your Biometric Residence Permit (BRP)

- A copy of your Certificate of Sponsorship (or the letter confirming your visa length)

BRP cards are being phased out at the end of 2024, so most checks will eventually move online. For now, lenders still ask for a physical copy.

4. Proof of Address

- A UK utility bill

- Or a bank statement with your address

- Or a tenancy agreement

Most lenders will accept one of these, but some may ask for more than one.

5. P60 and/or HMRC Tax Summary

This confirms your income and tax paid in the UK. It’s especially useful if you’ve been employed longer than 6 months.

6. Employment Contract

Some lenders want to see your signed contract of employment, especially if you’ve just started or are on a fixed-term contract.

7. Optional: Share Code

Rarely requested, but some lenders may ask for your right-to-work share code to verify immigration status.

Final Thoughts: Start with Strong Documents

Whether you’re a Skilled Worker visa holder, Spouse visa holder, or Graduate visa holder, your documents will either speed up or slow down your mortgage process. The sooner you gather them, and make sure they’re clean, clear, and verifiable, the more confident your lender will be.

At First Time Finance, we’ve helped hundreds of clients secure UK mortgages with the right paperwork. If you’re not sure what you need, or whether your current documents are enough, let’s talk.

Book your mortgage call today and we’ll walk you through it.